Are Paid MT4 Indicators Worth It?

If you're wondering whether it's worth spending money on paid MT4 indicators, the answer depends on your trading style, goals, and the tools you're already using. MetaTrader 4 offers a massive ecosystem of both free and paid indicators, and while many free tools can deliver solid results, there are cases where premium indicators bring real advantages.

Free MT4 Indicators: More Than Enough for Many Traders

There’s no shortage of free MT4 indicators that cover the most common trading needs. These tools often focus on:

- Trend Detection: Moving averages, MACD, Parabolic SAR, and ADX are widely available and reliable for identifying trend direction and strength.

- Volume Analysis: Indicators like On-Balance Volume (OBV), Money Flow Index (MFI), and custom tick volume tools help gauge the pressure behind price moves.

- Breakout Strategies: Free indicators like Donchian Channels, Keltner Channels, and pivot-based tools can help identify breakout zones and market volatility.

These indicators can be downloaded from the MetaTrader Market, MQL5.com, or popular trading communities—often with full documentation and update support.

When Paid Indicators Might Be Worth It

Paid MT4 indicators come into play when you’re looking for advanced features or automation that free tools don’t offer. Here are a few examples where a premium tool might be justified:

- Non-Repainting Indicators: Unlike repainting indicators that adjust historical signals, non-repainting indicators lock in signals once a candle closes, offering more reliable entries.

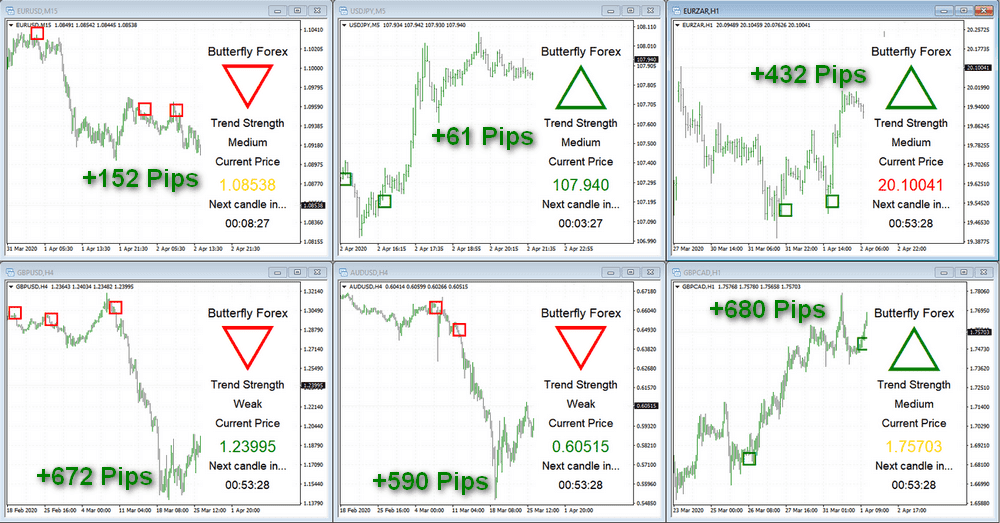

- Multi-timeframe and Multi-pair Scanners: Some paid indicators scan multiple charts at once and alert you when certain conditions are met—saving tons of time and manual chart checking.

- Custom Logic and Strategy Integration: High-end indicators may combine several data points, custom algorithms, and even AI-like behavior to adapt to changing markets.

- Built-in Trade Alerts and Auto-Execution: Some tools go beyond analysis and include integrated trade triggers, alert pop-ups, or even trade copying functionality.

How to Evaluate Before You Buy

Before spending money, always test and compare. Use these steps to make sure you're making the right call:

- Check for a free trial or demo version—many paid indicators offer limited-time trials or demo accounts where you can evaluate performance.

- Compare against free alternatives using your existing strategy. See if the paid indicator offers a clear edge in terms of accuracy, ease of use, or feature set.

- Backtest and forward-test in a demo environment using the MT4 strategy tester or manual testing. Measure hit rate, signal frequency, and drawdown behavior.

- Read reviews and seller history—check ratings, feedback, and the developer’s reputation in the MQL5 market or forums.

Use the MT4 Indicator Tutorial to Learn and Compare

If you're not familiar with installing or customizing indicators, start with an MT4 indicator tutorial. Learn how to:

- Install and configure both free and paid indicators.

- Apply them to charts with different timeframes and assets.

- Understand what the signals mean and how they integrate into your trading plan.

Final Verdict

Free MT4 indicators offer great value and cover most common strategies—especially for traders just starting out. However, paid indicators can provide an edge when you need non-repainting behavior, advanced scanning tools, or time-saving automation. Always test and compare based on your goals. Don’t pay for complexity unless it clearly improves your results or workflow.